WITH Christmas fast approaching, many families across Belfast are putting themselves at risk of a debt crisis, all so they can enjoy the traditional festive season.

Pressures from children, advertisers and peers can lead to some people taking out loans to pay for presents and other aspects of the season, but many find they are unable to keep on top of repayments.

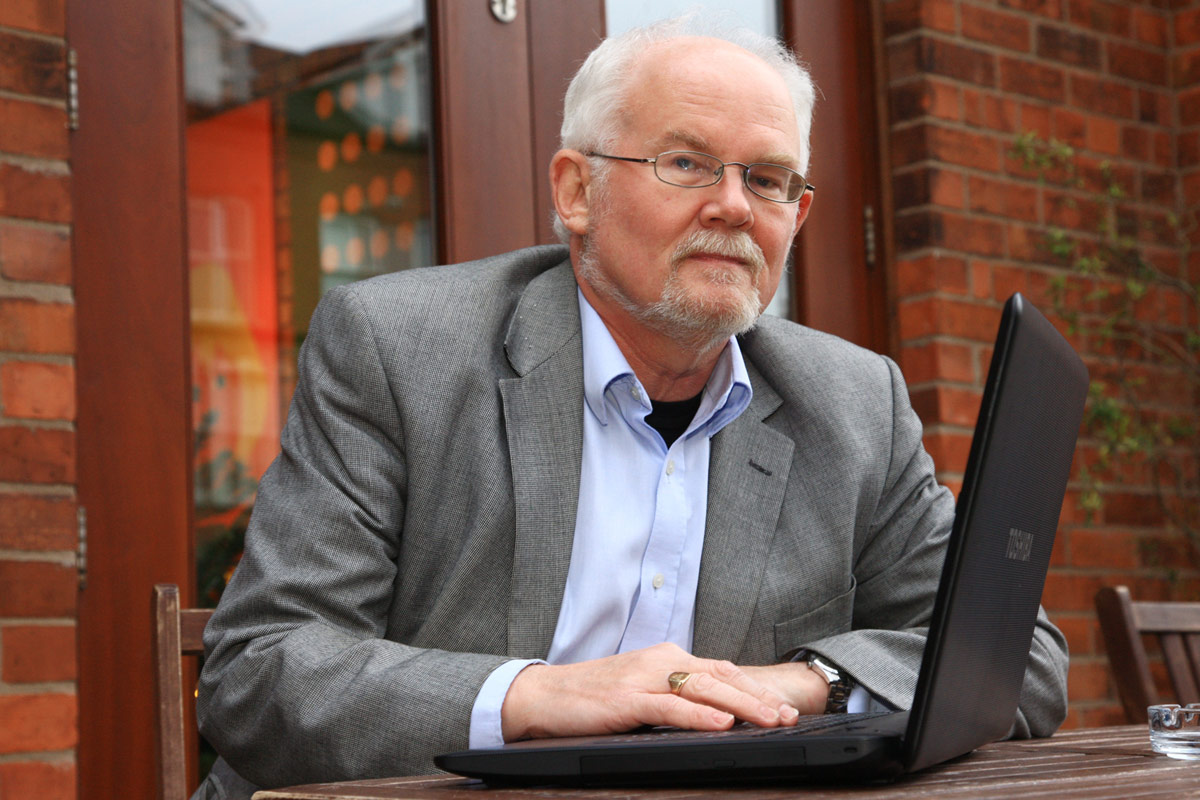

Jim Thompson who is the South and West Belfast centre manager for Christians Against Poverty (CAP), based in University Avenue has advised locals to do their Christmas shopping with a “clear strategy” to avoid landing themselves in a spiral of debt they could find difficult to escape from.

Despite their name and Christian ethos, the services provided by the charity are open to people of all creeds and none, from all over Belfast, and no-one will be turned away when faced with the trauma of debt.

In an interview with the Belfast Media Group, Mr Thompson warned that a high percentage of people living across the city were just one pay packet away from major debt problems while, with the annual spending extravagance of the festive season adding pressure on many families, some simply cannot afford to cope. In extreme cases, the pressure of debt can lead to family break-ups, serious mental health issues, and even suicide attempts. Disturbing statistics provided by the charity show that before turning to them for help, 80 per cent of clients admitted to “living in fear” as a result of their financial burdens, and 34 per cent considered taking their own lives,

“What puts Christians Against Poverty in a position of being able to help, is our close working relationship with many of the financial institutions,” Jim explained.

“When someone comes to us with concerns over their own financial situation, we don’t just advise them. We are in a position to negotiate a settlement with creditors, which eases the burden on the individual. When working on their behalf, in many cases we are able to set up an account or standing order which the individual pays into and we distribute their money to the various creditors on their behalf. We are also able to prevent unfair interest charges.

“I have found the holistic approach to helping, with a face-to-face service is the best way to ensure people know we care. At Christmas, we find that this is the starting point for debt in a lot of cases, and people often use it as an excuse to spend what they haven’t got. Sadly, our findings show that half of those who contact us with out-of-control debt have at some stage taken out a loan to cover the costs of Christmas.”

However, he stressed that it was possible to have a happy yuletide within a family’s spending means, and CAP have identified a number of sure-fire tips to enjoy all the season has to offer, without the looming shadow of financial crisis spoiling the season.

“Manage expectations early, and if things are tight, don’t be afraid to say so to family members,” Jim continued.

“Perhaps see if relatives will club together to buy children what they would really like, rather than over indulging them individually and everyone being left out of pocket. One of the best pieces of advice is to never take out a Christmas loan – the consequences could be disastrous.”

Enjoying a “low cost Christmas” is something the charity firmly believes in with many low cost alternatives to pricey goods and outings available across the city.

Even making your own festive decorations can cut the overall Christmas bills and, at the same time, provide an opportunity for the whole family to come together. CAP also recommend making and preparing your own food rather than paying for pricey shop-bought seasonal treats.

“You cannot buy love, and shouldn’t feel guilty about not being able to afford expensive presents. In fact this can be an opportunity to boost what the spirit of Christmas is all about anyway, being together with your loved ones.

“Family get-togethers, making your own food, and going out to enjoy the Christmas lights and carols are just some of the ways you can cut the costs but keep the spirit of the season.

“We can offer much more advice, along with helping those who feel they have already crossed the line into difficult territory.”

To contact CAP for advice or direct help with debt, call 0800 328 0006 to be put in touch with Jim, or visit www.capuk.org, for further details.