The statistics for young, male drivers is startling. Aged between 17-20, they are seven times more likely to crash than other male drivers. Statistics show that rate increases to 17 times more likely during the hours of 2am to 5am.

Risk is the key word when it comes to insurance companies. Statistics like these are one of the primary reasons why young drivers are often offered insurance premiums at annual rates that are more expensive than the price of a decent second hand car.

Like all insurance products the price you pay isn’t based on your driving per se, but on a more general curve of people in the same age group and gender.

“I would ask any young driver, do you want to be rated on how you drive or how people like you drive,” asked Tony McKeown of Crash Services. Crash is the first company in Northern Ireland to bring out a drivers’ ‘black box’ – a telematics system that, in plain English, tracks a car’s usage and reports the data back to a website.

The Ingenium Dynamics product is focused on improving driver safety and could be the key to lower premiums being offered by insurance companies to younger drivers.

“Once installed, the device gathers and transmits driving data,” said Tony.

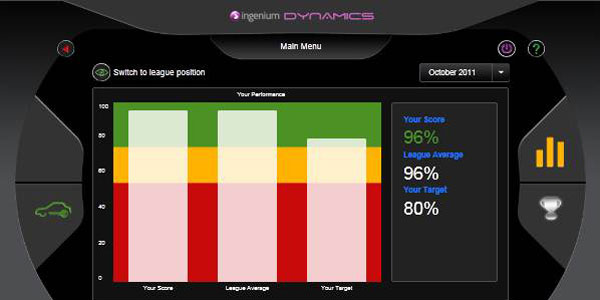

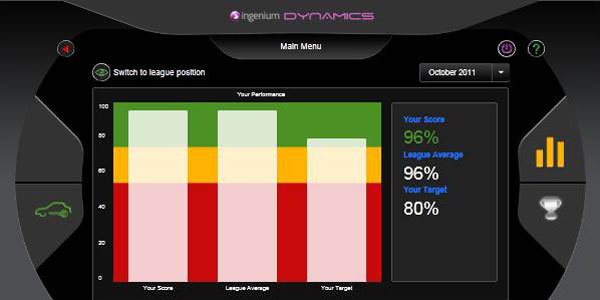

“The data is passed through algorithms and assessment is made of driving risk. This is categorised as high, medium or low risk. Information relating to all journeys can then be viewed by users on a secure webpage.”

The website shows everything from the direction, speed and location of the vehicle at any given time and the force of acceleration, braking or cornering if they have exceeded a certain level. It also highlights to the user all high or medium risk incidents and allows them to see what has caused them and where they occurred, right down to a view at street level on Google Maps.

“We have got a great product and the big thing for us is that it’s starting to grow in England and insurance companies are starting to jump on board with it and there’s lots of noise about it. There’s been a five-fold increase in young driver insurance policies sold with this technology.

“Some insurance companies are making it part of the package for young drivers. There are rumours of young drivers getting quotes for £10k, but no one is taking a policy out at that price, if insurance companies are pricing it like that, they don’t want the business. But say it was £3,000 for a young driver they’re now saying they’ll cut the price by around 40 per cent and the price of the black box and the monthly service charge is built in to that price.”

A 40 per cent drop in price is a massive incentive for any driver. In theory the Ingenium Dynamics black box could move the motor insurance industry from a generalisation of risk to being able to provide an on the money quote based on what your driving skills are rather than an average of how other drivers your age and gender perform.

I spent seven days in August test driving a car fitted with the technology to get a feel for how it works. My strategy was simple, start the week driving as I normally do and then find a few deserted areas to become a less than perfect driver.

Sitting back at Crash HQ looking at the results online, it’s startling to see the information provided on each journey. Google maps show your starting and end point and highlight in between green, amber and red driving points, with an overall percentage score.

Don’t understand why the system is telling you that your driving is poor? There’s a scenario for all such eventualities that you can see an example of where you’re going wrong.

It can be a great tool for parents too. If your teenage son or daughter are just on the road, you can keep an eye on their driving skills.

Insurance companies in England are still getting to grips with the way they’re implementing this new product. “Some have premiums based on 4,000 or 6,000 or 8,000 miles a year for a price. Some of them say if you continue to drive well for the rest of the year we’ll knock your price down by another 10 per cent. Some say if you drive badly we’ll charge you a penalty of £150 the first time and £250 the second time you do it. But, because this is such a young, emerging market they’re all trying different things and no one really knows where it will end up.”

The one thing that does seem plausible is this technology appearing in cars more so than not, especially given its many uses.

Keeping an eye on young drivers is just one way it can be used. Companies whose staff use fleet cars, vans or lorries can work out mileage with the click of a button as well as ensure that their drivers are taking care on the road.

But could this technology become mandatory for all new drivers? There’s no reason to think it shouldn’t. Most insurance companies pay for cracks to be fixed on windscreens without a second thought because it, ultimately, saves money down the line.

If introducing black boxes can help reduce accidents by encouraging better driving, then it can only be a good thing. Statistics reveal that fleets using the technology in England have reported a 25-80 per cent reduction in insurance claims and many users have seen fuel savings between five and 20 per cent.

Add in the fact that a recent European Court of Justice ruling means that taking the gender of an individual into account as a risk factor in insurance contracts constitutes discrimination, and there’s a simple reality that insurance companies need to change the way they weigh up risk.

One in five new drivers has a crash during their first six months on the road, maybe it’s time government looked at a bold, forward-thinking pilot study and introduce this technology for all new drivers. If it reduces the number of traffic accidents on our road, even by a minor percentage, surely it’s worth it?

Leading provider of accident services, CRASH, has exclusive licensing rights for the Ingenium Dynamics telematics system for the island of Ireland. You can find more information on www.crashservices.com or by calling 0500 27 27 47